2020 Outlook: Global Market Strategy – Asset Class Outlooks

2020 Outlook: Global Market Strategy – Asset Class Outlooks

Continued monetary policy accomodation supports capital markets

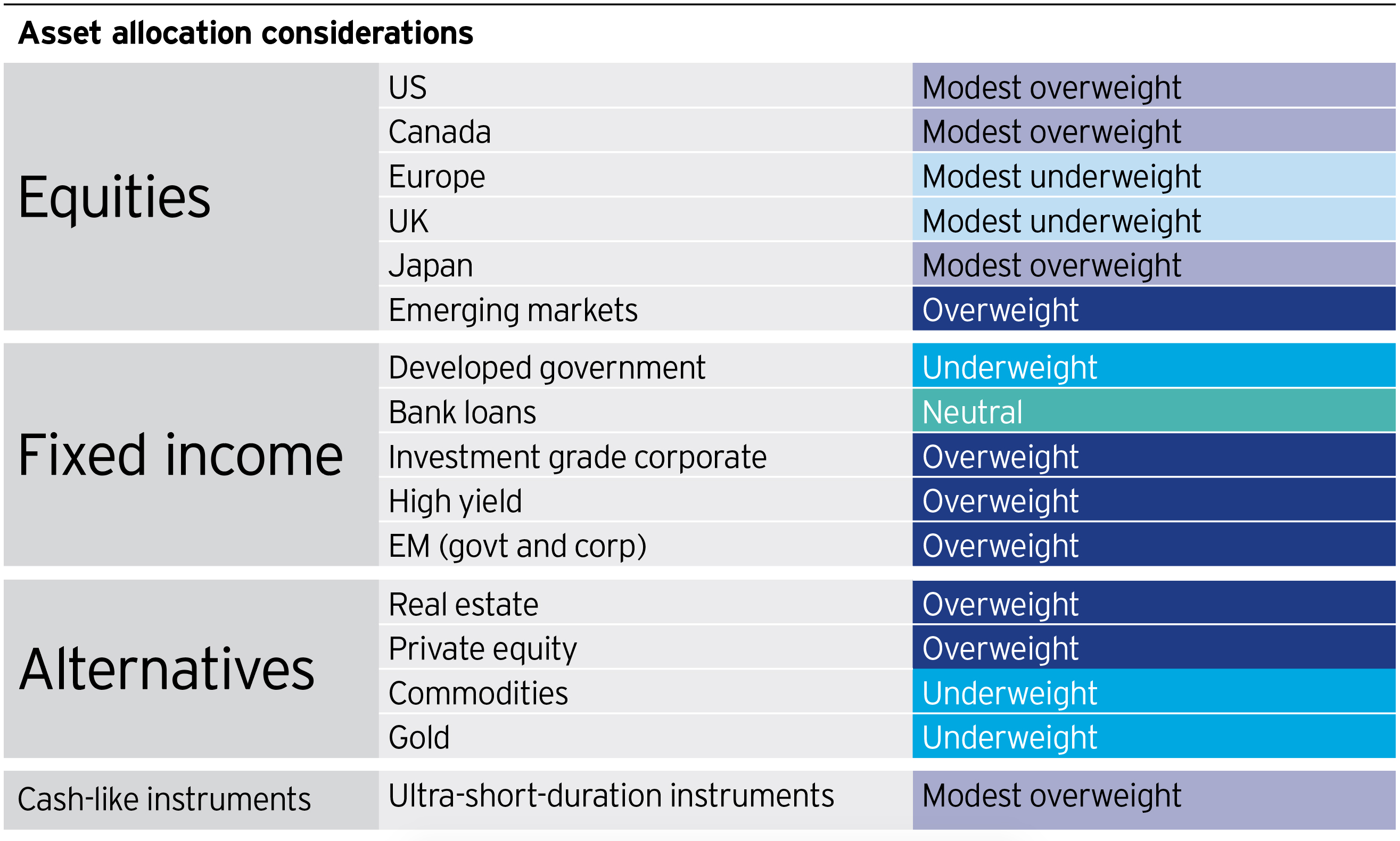

In addition to our regional outlooks, the Global Market Strategist Office has developed a view of various asset classes heading into 2020. We expect global economic growth to decelerate for much of 2020. Given that we expect continued monetary policy accommodation with little fiscal stimulus, we are more optimistic about capital markets than we are about economic growth. We therefore favor risk assets over non-risk assets.

Read on to find out more about our views for each asset class.

Equities

US. We believe the monetary policy environment will remain supportive of equities in 2020. However, we believe investors will need to be more discerning in this environment. Valuations appear stretched for US equities, in our view, but we recognize that valuations have not often been a good predictor of equity performance in the shorter term. In addition, we believe lower interest rates and low inflation make US equities more attractive. Also, the dollar has weakened recently because of “quantitative easing lite” policies that are expected to be ongoing. That should be positive for US equities. Therefore, we are bullish on US equities, with the caveat that investors should expect more volatility in the coming year.

Canada. We are modestly bullish on Canadian equities. We believe long-term Canadian equity underperformance could be coming to an end as Canadian stocks enjoy some advantages that may be underappreciated by investors. The United States-Mexico-Canada trade agreement (USMCA) appears poised to be ratified, which would benefit Canadian stocks. In addition, the Canadian manufacturing outlook remains positive, suggesting business sentiment is positive, which should bode well for equity returns. Also, Canadian stocks could benefit from a weaker US dollar and the potential for higher commodity prices.

Europe and UK. We are neutral on European (ex UK) equities. Valuations are very attractive (based on an analysis of dividend yield and cyclically adjusted price-earnings ratios), but we have not yet seen signs that the eurozone economy has reached an inflection point. We are bearish on UK equities. We believe it is reasonable to expect earnings declines and slower dividend growth, especially since a large portion of the UK market is exposed to either commodities or banks.

Japan. We are modestly bullish on Japanese equities given that we envision a moderately brighter economic picture for Asia and expect limited downside to US long-term yield in our base case, which will likely result in either more stable or even weaker yen. (It has often been the case that stronger yen worked negatively for Japan equities, including this year.)

Emerging markets. Overall, we are bullish on emerging market equities. Catalysts for emerging markets include a more accommodative Fed. In particular, balance sheet normalization recently ended, which should end the liquidity suck it created for emerging markets. We also expect the search for yield to drive investors to emerging market equities. Asian emerging equities should benefit from fiscal stimulus from China and India. Chinese stocks in particular should benefit from Chinese financial liberalization and the increased weighting of Chinese A share stocks in MSCI indexes. We are bearish on Latin American equities, many of which are too closely tied to the fortunes of commodities prices and some of which we expect to suffer from policy uncertainty. We have a neutral view of emerging Europe equities given decelerating growth in the euro area.

Fixed income

Within fixed income, we believe that higher-yielding investments will outperform given the low rate environment. Therefore, we are bearish to developed government bonds with the exception of UK gilts, whose returns should be driven by declining yields. We prefer investment grade credit to developed sovereign credit, given the former’s higher yields and better total return potential. We are positive on high yield bonds, although we prefer US high yield to eurozone high yield. Even allowing for a widening of spreads and a rise in default rates, we expect returns to be better than that of lower-yielding fixed income asset classes. We are also positive on emerging market debt, also given higher yields and greater total return potential.

Alternatives

Real estate. We are most positive on real estate, given its relatively high yields and potential for outperformance in what we expect to be a relatively low return environment. We favor eurozone and emerging market real estate but favor avoiding UK real estate until Brexit is resolved.

Gold. We are bearish on gold. While we recognize the diversification benefits of gold as well as a lower opportunity cost given lower rates globally, we expect low returns for gold in the coming year given the rally it experienced this year. In addition, gold typically performs best in recessionary or stagflationary environments, neither of which we expect for next year.]

Private equity and hedge funds. Private equity looks attractive in this environment given its risk-adjusted return potential, while we are neutral on hedge funds.

Commodities. We are bearish on commodities, as we believe valuations are much higher than historical norms for commodities in real terms. In addition, our historical analysis suggests that industrial commodities have performed poorly when the Fed is cutting rates.

Cash

We have a slight bullish view of cash-like instruments, preferring ultra-short-duration instruments. Our rationale is that such investments can offer a “safe haven” alternative to gold, and are currently more attractive than gold given the latter’s stretched valuations]. In addition, given the volatility markets are experiencing, having adequate cash on hand enables investors to take advantage of opportunities created by downward volatility.

Read the Global Market Strategy office's regional outlooks here.

The Global Market Strategy Office is headed by Kristina Hooper, Chief Global Market Strategist (New York). Members include: Brian Levitt, Global Market Strategist, North America (New York); Arnab Das, Global Market Strategist, EMEA (London); David Chao, Global Market Strategist, APAC (Hong Kong); Tomo Kinoshita, Global Market Strategist, Japan (Tokyo); Luca Tobagi, Product Director, Investment Strategist (Milan); Paul Jackson, Global Head of Asset Allocation Research (London); Talley Leger, Investment Strategist (New York); Tim Horsburgh, Investment Strategist (New York); Andras Vig, Multi Asset Strategist (London); Ashley Oerth, Investment Strategy Analyst (New York).

Important information

The opinions referenced above are as of November, 2019.

This document has been prepared only for those persons to whom Invesco has provided it for informational purposes only. This document is not an offering of a financial product and is not intended for and should not be distributed to retail clients who are resident in jurisdiction where its distribution is not authorized or is unlawful. Circulation, disclosure, or dissemination of all or any part of this document to any person without the consent of Invesco is prohibited.

This document may contain statements that are not purely historical in nature but are "forward-looking statements", which are based on certain assumptions of future events. Forward-looking statements are based on information available on the date hereof, and Invesco does not assume any duty to update any forward-looking statement. Actual events may differ from those assumed. There can be no assurance that forward-looking statements, including any projected returns, will materialize or that actual market conditions and/or performance results will not be materially different or worse than those presented.

The information in this document has been prepared without taking into account any investor’s investment objectives, financial situation or particular needs. Before acting on the information the investor should consider its appropriateness having regard to their investment objectives, financial situation and needs.

You should note that this information:

• may contain references to amounts which are not in local currencies;

• may contain financial information which is not prepared in accordance with the laws or practices of your country of residence;

• may not address risks associated with investment in foreign currency denominated investments; and

• does not address local tax issues.

All material presented is compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. Investment involves risk. Please review all financial material carefully before investing. The opinions expressed are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

The distribution and offering of this document in certain jurisdictions may be restricted by law. Persons into whose possession this marketing material may come are required to inform themselves about and to comply with any relevant restrictions. This does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer is not authorised or to any person to whom it is unlawful to make such an offer or solicitation.